The Ultimate Guide to Passive Income for Introverts: How to Build Quiet Wealth at Your Own Terms

The Ultimate Guide to Passive Income for Introverts: How to Build Quiet Wealth at Your Own Terms

When you check in, the world of "passive income" can feel incredibly loud.

It's filled with flashy online gurus promising you'll make $10,000 by next week if you just buy their course. It's the pressure to become a charismatic salesperson, to be "on" all the time, to network until you're completely drained.

If you're an introvert, that world is just what you don't want at all, unappealing—it's exhausting, unrealistic. It feels like a party you never wanted an invitation to.

Amidst all that noisy promises, we can ask the right questions:

What if we've been thinking about passive income all wrong?

What if it's not about becoming someone you're not, but about building smart, automated systems that make money for you?

What if the goal isn't just wealth, but something even more valuable: financial calm.

That's what this guide is about. This is a no-fluff, realistic map to building income streams that respect your personality. We'll walk through the real options, highlight the ones that play to your introverted strengths (like deep research and focused activities), and be brutally honest about the time, effort, and risk involved.

Read on to get a clear path to building your own version of quiet wealth.

Part 1: What's The Appropriate Introvert's Mindset for Wealth

Before we talk about strategies or bank accounts, we need to talk about your most important asset: your mind.

The typical money-making advice screams "hustle." It tells you to push, promote, and be loud. It can make you feel like you're broken because that path feels so wrong.

But you're NOT broken. You just have a different—and in many ways, more powerful—set of skills for this game.

Think about it. What does building genuine, long-term wealth require?

Patience, not impulsiveness.

Deep research, not following the latest hype.

Consistency, burning a slow and steady flame, not a flash in the pan.

Creating systems that work on their own, without constant hand-holding.

These are the natural strengths of a thoughtful, introverted person. While others are chasing the next shiny object, you are capable of building something that lasts.

The First, Non-Negotiable Step: Getting Real

Let's slice through the biggest myth right now: passive income is never 100% passive.

Digging deep, the reality is that The word "passive" is a bit of a trick. It doesn't mean "no work." It means the income isn't directly tied to your time after the initial heavy lifting.

Think of it like planting an oak tree. You put in the hard work of digging, planting, and watering at the start. Then, for years, it grows on its own, providing shade and value without your daily effort.

Some streams require more upfront digging than others. The main idea is to find the type of "digging" that doesn't drain your soul.

So, ask yourself this before we go any further: What is your true 'Why'?

Is it to escape a draining job? To create a safety net that reduces your anxiety? To buy yourself the freedom to spend more time on your hobbies, alone or with a few close people?

Your "Why" is your anchor. It's what will keep you going when the initial excitement fades and the real work begins. Hold onto it tightly.

Part 2: The Landscape of Earnings: Your Passive Income Spectrum

Trying to compare a high-yield savings account to creating an online course is like comparing a quiet walk in the woods to building a treehouse.

They're both related to nature, but the experience is completely different.

To make sense of it all, let's stop thinking in a simple list and start thinking in terms of a spectrum.

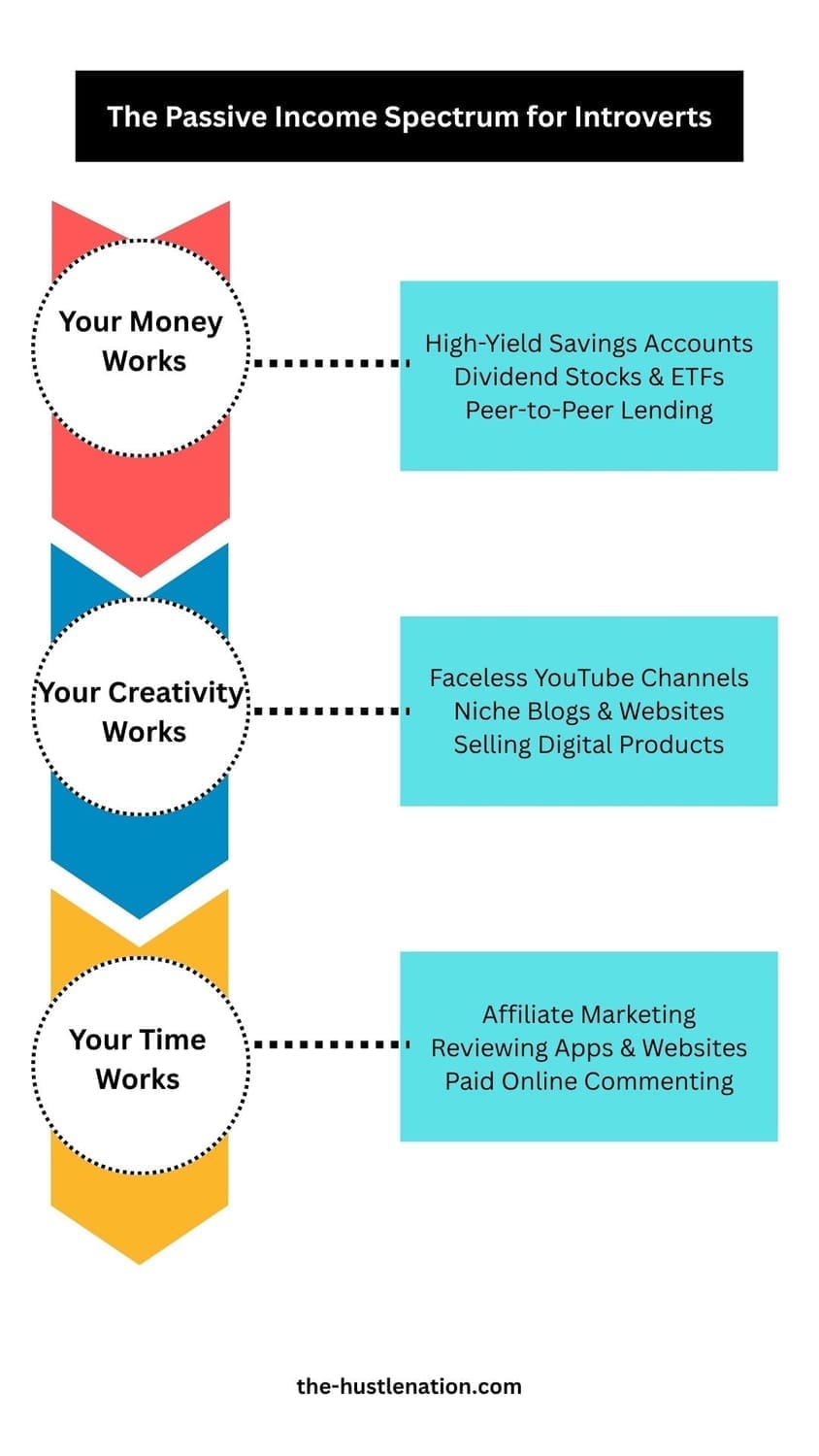

This spectrum runs from "Truly Hands-Off" to "Leverage-Based" income. Where you start depends entirely on your current resources:

namely, your time and your capital.

Imagine a sliding scale:

The "Truly Hands-Off" End (Your Money Does the Heavy Lifting)

Trying to compare a high-yield savings account to creating an online course is like comparing a quiet walk in the woods to building a treehouse.

They're both related to nature, but the experience is completely different.

To make sense of it all, let's stop thinking in a simple list and start thinking in terms of a spectrum.

This spectrum runs from "Truly Hands-Off" to "Leverage-Based" income. Where you start depends entirely on your current resources:

namely, your time and your capital.

Imagine a sliding scale:

The "Sweet Spot" Middle Ground (Your Creativity Builds the Machine)

This is where the digital magic happens. You invest your time and skill once to create an asset that continues to pay you over time.

What it is: Building a niche website that earns ad revenue, creating a YouTube channel without showing your face (using faceless videos), writing and publishing an eBook, designing digital printables, or even building a paid Discord community.

The Quiet Touch: This plays perfectly to your ability to focus deeply and create valuable things behind the scenes. You're building a system—an automated digital employee.

Reality Check: The upfront "digging" here is significant. It can take months of consistent work before you see a single dollar. But once the machine is built, it can generate income for years with only minor maintenance.

Learn More: We explore the mechanics of this in posts like How to build a Fully Automated Small Business using AI and in the post titled: How to create a paid discord community.

The "Leverage-Based" End (Your Time Earns Scalable Income)

To be perfectly clear: these are presented as passive but are not really fully passive in the traditional sense.

They are structured to be less draining than a traditional job and can be scaled in unique ways.

What it is exactly: Affiliate marketing, getting paid to review apps or comment on social media, certain types of online freelancing where you create a reusable template or asset.

What's in it for introvert people: These are fantastic low-barrier-to-entry options. They require minimal to zero startup cash and let you test the waters of making money online. You can often do them on your own schedule, in your own space.

The Reality: This is "active income" in a more flexible package. Your income is directly tied to your ongoing activity. However, the goal is to use the skills you learn here to eventually build a system from the "Middle Ground."

Related: Check out our lists of 16 Free Ways To Make Money Online From home and How to Earn Money by Reviewing Apps for practical starting points.

So, where should you focus? That brings us to our next step: a simple self-assessment.

Still here? Test yourself then.

Part 3: Find Your Fit: A Quiz for the Overthinker (We Mean That in a Good Way!)

With so many options, knowing where to begin is often the hardest part.

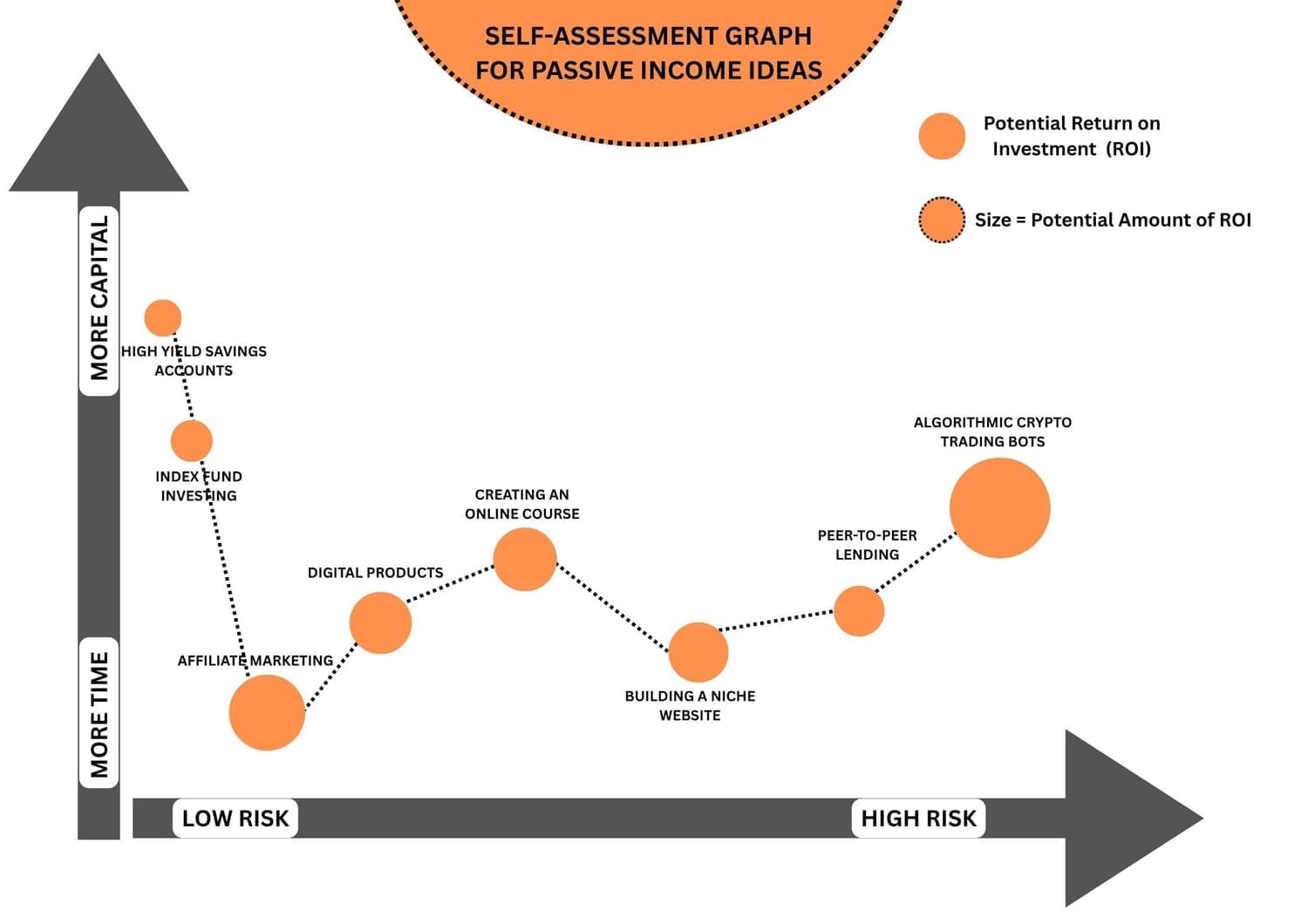

The good news is, you don't need to do everything at once. The best strategy for you depends on two main things: the resources you have now and your personal comfort with risk.

Let's break it down into a simple, two-step process.

Step 1: Assess Your Resources (Time vs. Capital)

Every passive income journey starts with a really honest look at your available resources. Do you have more time to invest, or more capital?

If you have more time than capital right now, your path likely begins with building systems and skills. This path leverages your ability to focus and create. It includes:

Digital Assets: Creating a niche website, a faceless YouTube channel, or writing an eBook.

Leverage-Based Work: Affiliate marketing, reviewing apps, or online freelancing with reusable templates.

Community Building: Starting a paid Discord community around a shared interest.

These approaches require significant upfront effort but often need little to no startup money.

They are about building an asset that pays you over time. For a detailed list of ways to start with zero capital, our guide on how to make money online with $0 offers practical first steps.

If you have more capital than time, your path can start with putting your money to work. This is the classic "hands-off" approach and includes:

Low-Risk Investments: High-Yield Savings Accounts (HYSAs), government bonds, and broad-market index funds.

Alternative Lending: Peer-to-peer lending platforms.

This path is often slower but requires less daily management after the initial setup.

For those with savings to allocate, our analysis of how to pour in $100k for passive income provides a framework that can be scaled to any amount.

Step 2: Gauge Your Risk Tolerance

Understanding your comfort level with uncertainty is crucial for building sustainable "quiet wealth."

There is no right or wrong answer; the goal is to choose a path that lets you sleep soundly at night.

Low-Risk Tolerance: You prioritize safety and stability over high returns. Your comfort zone includes FDIC-insured accounts and established, diversified investments. The primary goal here is capital preservation with steady, predictable growth.

Medium-Risk Tolerance: You are willing to accept some fluctuation in returns for greater potential growth. This includes building digital businesses, which carry the risk of not gaining traction, or platforms like peer-to-peer lending.

High-Risk Tolerance: You are comfortable with significant volatility and potential loss for a chance at higher rewards. This area includes speculative assets and automated trading systems. It is essential to approach these with extreme caution and only with capital you can afford to lose. We rigorously test these opportunities, as in our Korvato AI review, to provide clear, verified data.

Your Action Plan: Where to Begin

Based on your self-assessment, here are clear starting points:

Start with Time & Low Risk: Begin with low-commitment, leverage-based activities like getting paid to review apps or comment. This builds confidence and generates initial cash flow with minimal risk.

Start with Capital & Low Risk: Open a High-Yield Savings Account (HYSA) immediately. This is the single easiest step to start earning a better return on your cash with zero ongoing effort.

Start with Time & Medium Risk: Choose one digital asset to build. Research a niche for a website or plan a series of faceless YouTube videos. The key is to start creating.

Start with Capital & Medium Risk: Diversify a portion of your investment portfolio into a peer-to-peer lending platform or explore dividend-focused ETFs.

The most important step is the first one. Choose one action that aligns with your current resources and comfort level. Consistent, small steps build the foundation of lasting passive income.

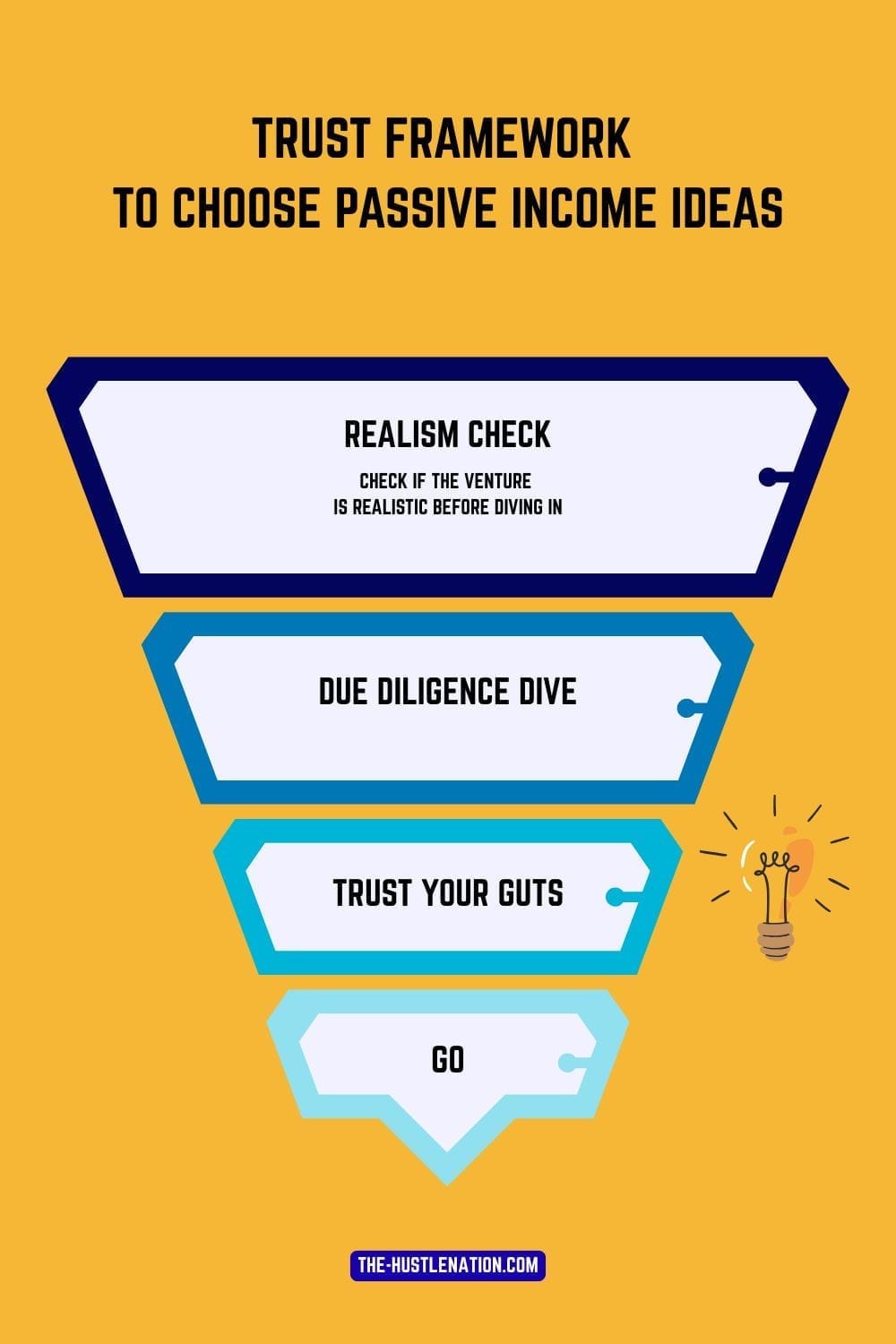

Part 4: The Trust Framework: How to Vet Any Income Opportunity

Let's talk about the elephant in the room: the internet is full of promises that are simply too good to be true. For every legitimate opportunity, there are a dozen others designed to separate you from your time and money.

As introverts, our natural skepticism and tendency to research deeply are actually superpowers here. This framework will help you systemize that instinct, turning it into a reliable shield against hype and scams.

1. The Realism Check: The First Filter

Before you even click "learn more," apply this simple litmus test. If an opportunity fails even one of these points, it's a hard pass.

The "No Work, No Risk, High Returns" Triangle: You can only ever pick two. An opportunity promising all three is mathematically impossible and financially fraudulent. Legitimate investing always involves a trade-off between these factors.

The Income Claim Test: Are they showing you a real, verifiable payment proof? Or just a slick screenshot? Do they use phrases like "this could be you" instead of "this was me"? Vague claims are a major red flag.

The "Why Are They Selling This?" Question: If a method for making money is so effective, why is the creator spending all their time selling a course about it instead of just doing it? Often, the course is the primary business model.

2. The Due Diligence Deep Dive: Your Research Toolkit

Once an opportunity passes the initial filter, it's time for a deeper investigation. This is where your introverted strength for focused research pays off.

Scour Independent Sources: Never rely solely on the sales page. Go to some trusted, third-party sites.

Search on Reddit: Use search terms like "[Product Name] reddit" or "[Product Name] scam". Look for discussions in communities like r/beermoney, r/passive_income, or r/antimlm. Pay attention to repeated complaints.

Check Review Sites: Look for detailed reviews from established financial or tech blogs (like the ones we provide). Are they critically examining drawbacks, or just reposting the sales copy.

Search the SEC: For any traditional investment platform (like those selling stocks or bonds), check the U.S. Securities and Exchange Commission's (SEC) EDGAR database to see if they are properly registered. However, understand the limits of this tool. Innovative tech companies, like many trading bot services or decentralized finance (DeFi) platforms, often operate in a different regulatory space. For these, the absence of an SEC filing isn't an automatic red flag, but it does place a heavier burden on you to scrutinize their business practices, track record, and transparency.

Understand the Business Model: How does the opportunity actually make money? If you can't clearly explain it in one or two sentences, that's a problem. A legitimate business has a clear value proposition. A questionable one often has a convoluted model that relies on recruiting others.

3. The Introvert's Intuition: Listening to Your Gut

Finally, trust the feeling in your stomach. The marketing for many schemes is designed to create FOMO (Fear Of Missing Out) and pressure you into a quick decision.

Does it feel like a pressure cooker? Are there countdown timers, limited-time offers, and messages about "this opportunity closing soon"? Legitimate businesses don't need to pressure you.

Does it ask you to be someone you're not? Does the strategy require you to become a loud, pushy salesperson? If it clashes with your core personality, it's not the right path for you, no matter what the income potential is.

There's a profound difference between developing a new skill and fundamentally faking your personality.

Stepping outside your comfort zone to learn copywriting or record a video is growth. But constantly performing the role of a loud, pushy salesperson when it drains your soul is an excellent recipe for burnout.

A good strategy feels like a challenge that fits you. A bad one feels like a costume you have to wear.

By applying this three-layer framework—the Realism Check, the Due Diligence Deep Dive, and your trust your own Intuition—you can approach any new opportunity with confidence.

This is not really being cynical; it's all about choosing smart. This disciplined approach is what separates those who build quiet wealth from those who chase loud losses.

Conclusion: Your Journey to Quiet Wealth Starts with a Single Step

The path to passive income isn't a frantic sprint. It's a quiet walk you design for yourself. It’s about building systems that respect your time, your energy, and your need for calm.

The goal is not to avoid changing and stay stuck in your ways. It's to step out of the Comfort Zone for a better you.

The goal isn't to become a different person. It's to use your innate strengths—your patience, your deep focus, your ability to research and build—to create financial breathing room.

This is what "quiet wealth" truly is: not just money in the bank, but the profound sense of security and autonomy that comes with it.

You don't need to do everything at once. In fact, you shouldn't. The most sustainable progress comes from choosing one starting point that matches your resources and comfort level.

Open that High-Yield Savings Account.

Draft an outline for that eBook.

Set up a profile for one app-reviewing site.

Make that first move. Then the next. Your journey is unique, and it unfolds one deliberate, well-researched step at a time.

This guide is your central hub. Bookmark it by pressing CTRL + D.

Return to it whenever you feel unsure. And as you explore, dive into the specific, deep-dive articles we’ve linked throughout.

They are here to give you the detailed, trustworthy answers you need.

The door to building wealth on your own terms is open. You have the map. All that's left is to take that first step.

BE THE FIRST TO LEARN NEW WAYS TO MAKE MONEY

Learn how to earn money without being 100% involved in the process. Even if you're a beginner.

Learn how to start a private community where people will pay to access your content.

Algorithmic trading uses trading advisors to place trades on the markets to earn profits while you're somewhere else.

12 creative and realistic ideas to turn 10k into 100k for profit. Read more

The New Way to Start Affiliate Marketing. How to make it less time consuming while earning more even as a beginner. Read more

By Julian Croft

Julian Croft (Jesse) is the founder of The Hustle Nation, a blog dedicated to helping introverts build genuine passive income (not the hyped one) through faceless, sustainable methods. After a decade in data analysis, he now uses his research skills to cut through the online hype and deliver actionable, trustworthy advice.

The Hustle Nation is your #1 community to find side hustle ideas, online side jobs and passive income ideas for introverts. Join part-time hustlers on the path to financial freedom with proven strategies, tools, and inspiration to benefit from your free time. Learn newest tricks to earn money on the internet without showing your face on a camera. All our posts are not financial advise. Always do Your Own Research for informed decision.