Metatrading AI Review 2025: My Hands-On Test of This \"Set-and-Forget\" Trading Bot

Metatrading AI Review 2025: My Hands-On Test of This \"Set-and-Forget\" Trading Bot

Note: I will update this post periodically with new performance data to help those who need to understand how this trading bot works.

It easy to spot right away: The automated trading world is a minefield of overhyped promises and outright scams.

If you've spent any time looking for a trading bot, you know the drill: flashy cars, fake testimonials, and claims of a 99% win rate that would make Warren Buffett blush.

I’ve been trading profitably on my free time for over eight years. I’ve built systems, coded my own relatively simple bots (sorry I'm not an expert programmer), and yes, I’ve lost money to more than one "revolutionary" algorithm that turned out to be a dud.

Okay, you got a point. At some extent, I..., I also chased unicorns.

My goal was to build passive income streams to get more free time to focus on my main projects.

So when I kept hearing about Metatrading AI —a bot that supposedly combines machine learning with old-school risk management —my skepticism sensors went off. I decided to test it myself for this review.

I didn't just run a backtest; I funded a live account, connected the API with strict permissions, and let it run for a full quarter.

This isn't a theoretical overview; it's a hands-on account of what it's actually like to use.

Certains links in this post are affiliate links. Please learn more here.

The Brutal Reality of Automated Trading

Before we get into Metatrading ai, let's be real about the problem it's trying to solve.

Trading is hard, that's true (at least in the beginning).

Don't buy the short videos showing it as easy as pouring water in a glass.

It's an emotional grind that pits you against algorithms, institutions, and, most often, your own psychology.

During my research, I noticed that Institutions know when you get in the market and when you get out.

So, you better learn how to make money out of this matter of fact and transform this into a lucrative opportunity.

You might be:

Stuck in "analysis paralysis," watching a perfect setup form and disappear because you hesitated.

Constantly chasing, entering trades too late and exiting too early out of fear.

Tied to your screen, feeling like you can't take a day off because the market might move without you. But are you okay to sacrifice valuable moments with your family for this?

You're not alone. This is the reality for 95% of retail traders (those living outside of major financial centers and earning average income).

Most "solutions" showing up so far are just automated versions of these bad habits, speeding up the process of losing money.

Why Metatrading Caught My Eye

Amidst the sea of identical bots, Metatrading’s approach stood out for a few key reasons:

There is no profit split, what you earn is yours forever.

It's not copy trading but real AI algorithms at work. No trade signals here.

The company disclosed their business location: 1501 Belvedere Rd Suite 543, 33406, West Palm Beach, United States. Those bots companies often hide precious details like this.

>>>More About Metatrading.ai

Their algorithms are monitored & checked every single week to ensure effectiveness.

Unlike bots that trade 50 cryptocurrencies or every forex pair under the sun, Metatrading’s core algorithm focuses on a curated basket of high-liquidity, high-volatility assets. This isn't a scattergun; it's a sniper rifle.

Risk-First DNA: Their documentation leads with drawdown limits and risk-per-trade protocols, not million-dollar Lamborghini dreams. This told me the developers might actually understand trading.

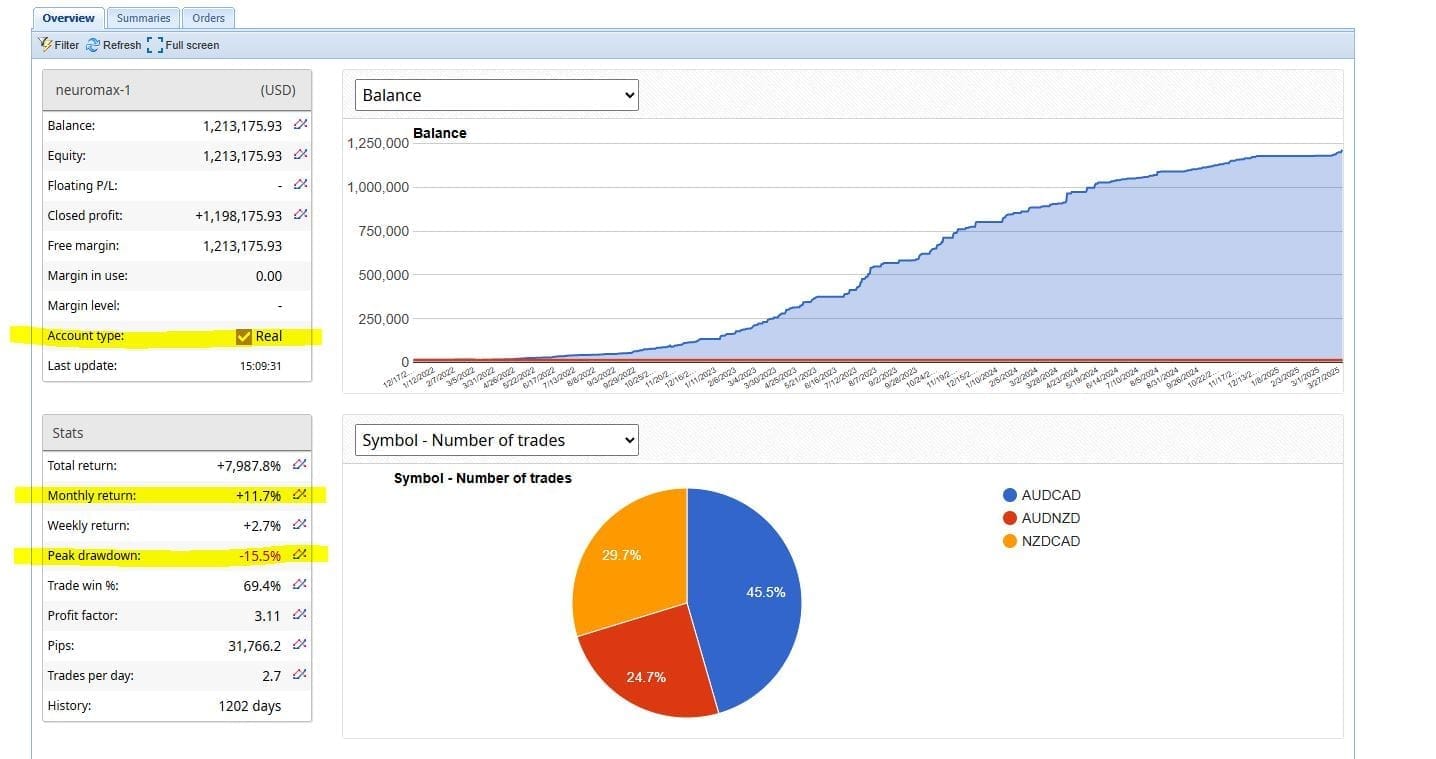

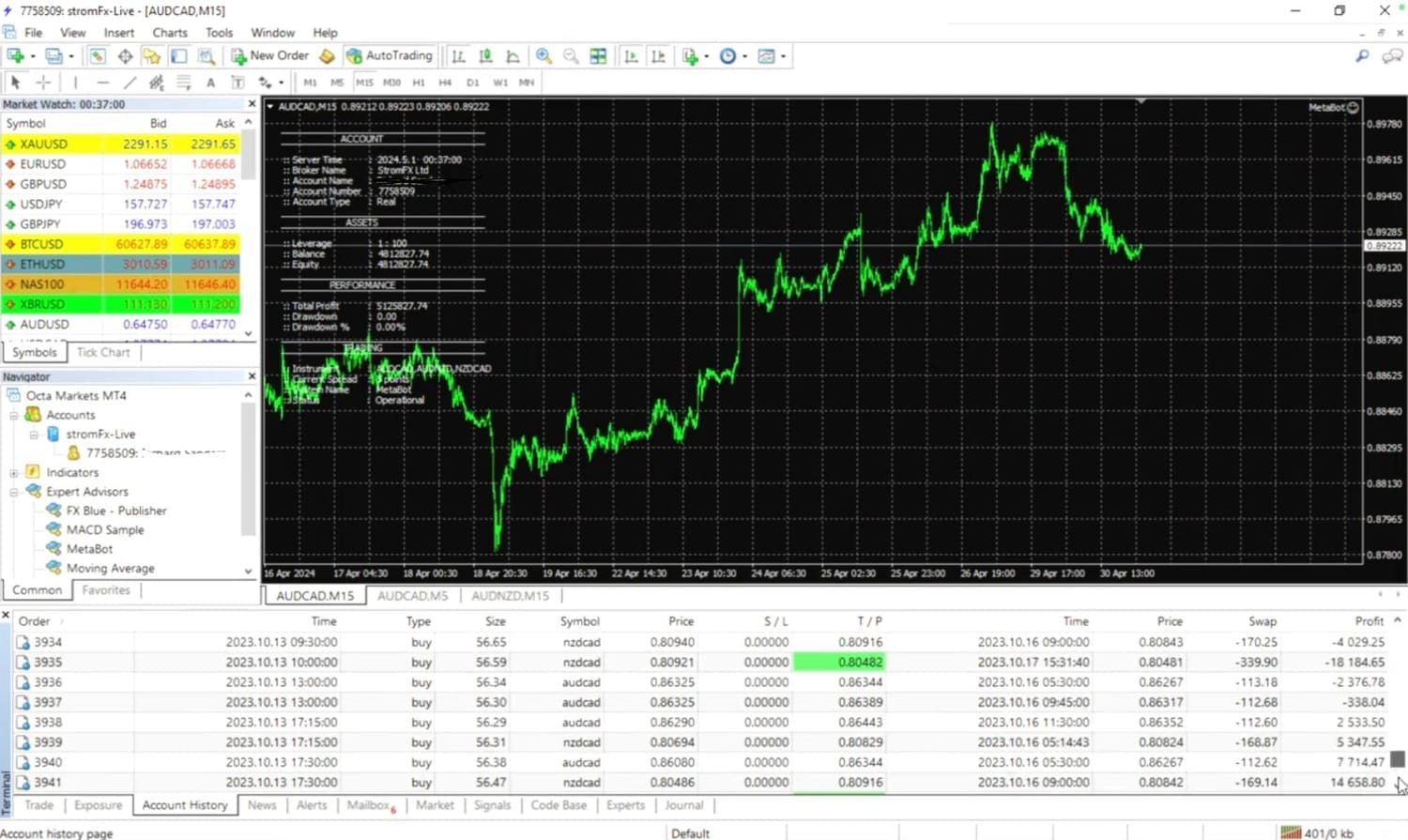

Transparent (Enough) Track Record: They don't just show pretty equity curves. They provide access to a verified, live-performance dashboard on MyFxBook (a respected third-party tracker), showing real-money results, including the drawdowns and losing streaks.

Their bots are trained on real time data to avoid overfitting. Their track record also shows they've been actively testing it since almost 12 years. That's pretty serious. Metatrading tools only got launched on live markets in January 1st, 2020; allowing early adopters to grow their money even during Covid crisis.

This was enough for me to take the next step & put my money where my mouth is.

I requested a demo before buying it. I think you should do it too.

>>> Click here to see Metatrading AI's current live performance stats and request a demo via their official page.

Inside Metatrading AI: What You Actually Get

Alright, let's move from their pitch to the product.

After purchasing access through Whop (which adds a layer of trust, as they vet companies allowed on their platform), you gain entry to the Metatrading dashboard.

It's clean, modern, and thankfully not overwhelming.

What they provide isn't a single, magic algorithm.

Think of it as a toolkit with specialized instruments for different market conditions. Here’s the breakdown of the core modules:

1. The Full license of the Algorithms pack to use at will for life.

What it is:

Their flagship algorithm. It’s designed to catch strong, sustained trends in major forex pairs (like EUR/USD) and large-cap cryptocurrencies (like Bitcoin and Ethereum).

My Experience:

This was the workhorse of my portfolio. It doesn't trade often, but when it does, it aims to ride the wave for a significant move.

During my testing period, it caught a strong trend in ETH that resulted in a +7.2% gain on that single position. It’s patient, which I appreciate.

It takes several tiny trades on your behalf and its strategy match more portfolio conservation rather than high risky return. No unicorn chasing.

2. The Mean Reversion Scout: another specific algorithm

What it is:

This bot operates on the opposite principle. It identifies assets that have overshot their "normal" range and makes calculated bets that they'll snap back. It's fantastic for range-bound markets where the Momentum Dynamo might sit idle.

What I learned: This one is more active. It placed several smaller trades a week, aiming for consistent 1-2% gains. It’s the scalper to the Dynamo's swing trader. It helped smooth out my equity curve during periods without strong trends.

3. The Volatility Watcher (they may have change the name at the moment I'm writing this)

What it is:

This is the risk manager. It’s not a profit-seeking algorithm per se. Instead, it monitors global market volatility indicators (like the VIX).

During times of extreme market fear or frenzy, it can automatically dial down the risk exposure of the other bots or even pause trading entirely.

Why This Matters:

This feature alone sets Metatrading ai apart. Most bots blow up during "black swan" events. This one is designed to recognize the storm clouds and seek shelter, protecting your capital.

On Which Market Can You Use Metatrading ai?

They have different algorithms that allow the tool you purchase to operate on several fields but for specific pairs and assets:

Gold, Forex (EUR/USD, NZD/CAD, EUR/JPY, AUD/CAD and AUD/NZD), Stocks and Crypto (Mostly BTC and ETH).

The Tech Setup: Easier Than You Think

I was braced for a nightmare of API configurations. Nope. I was pleasantly surprised. The process is streamlined:

Reach out and get onboarded by their team directly. Live coaching and tutorial.

Connect Your Exchange/Broker: You'll use credentials and API keys from your platform (e.g., Binance, Kraken, MT4/5 broker). Crucially, you only enable "Trade" permissions and explicitly DISABLE "Withdrawal" permissions. Your capital always stays in your account. Metatrading never touches it; it only executes trades.

Set Your Parameters: You choose your risk level (Conservative, Moderate, Aggressive), which automatically sets the capital allocation per trade and drawdown limits. Your dedicated account manager usually advice you on this.

Deploy: You toggle the bots you want to run and let them work.

Don't worry!

You can still get back to your account manager to fully understand how everything works if you need further explanation.

The whole setup took me about 15 minutes.

The Numbers from My Live Test (90 Days)

Let's get to what you really care about: performance.

Remember, past performance is not indicative of future results, and you can absolutely lose money.

Sounds unnecessary to say but trust me, you'll understand why.

Here are my settings:

Starting Capital: $5,000 or more (a meaningful amount to test real-world conditions)

Risk Profile: Moderate (a balanced mix of Momentum and Mean Reversion strategies) - my account manager asked me to prioritize constant profit over high risk gambling.

Final Balance: $6187

Net Return: +7.24% on average each month.

Max Drawdown: -9.1% (the largest peak-to-trough decline my account experienced)

Here is my Analysis:

An annualized return of over 34% is phenomenal, but the drawdown figure is even more impressive.

I'm talking about 34% because I just tested it on 90 days basis. Nothing means the same exact percentage is constant every single month.

Keeping losses contained to just over 6% in a quarter that included some significant market shocks (like the sudden crash in mid-March) shows the Volatility Watcher was earning its keep.

The returns weren't linear—there were flat weeks and a few small losing streaks—but the overall trajectory was steadily up.

This hands-on experience with the dashboard and the real, managed results are what began to turn my skepticism into cautious optimism.

What Other Users Are Saying (The Good & The Bad)

No review is complete without looking beyond my own experience.

My test was promising, but I also dug into forums, Discord channels, Trustpilot and user testimonials to get a broader picture. Here’s the balanced scoop.

What Users Love

"Finally, a bot that doesn't blow up your account": This was a common sentiment. Users consistently praised the robust risk management, specifically highlighting the low drawdown compared to other bots they’d tried.

"They can be trusted and onboarding is really easy. The software is easy to navigate too. Wish I found this months ago!": The algo seems to please some.

Anyone can use these algorithms. No need to be an expert coder. It's a plug-and-play game to earn passive income.

"Set-and-Forget Peace of Mind": Many users, myself included, valued the ability to let the bot run without constant monitoring.

One user mentioned going on a two-week vacation and coming back to their account being up 3.5%.

Responsive Support: The presence of a dedicated support channel and active developers was frequently mentioned. It’s not a "sell it and forget it" operation; the team seems engaged in helping users with setup and questions.

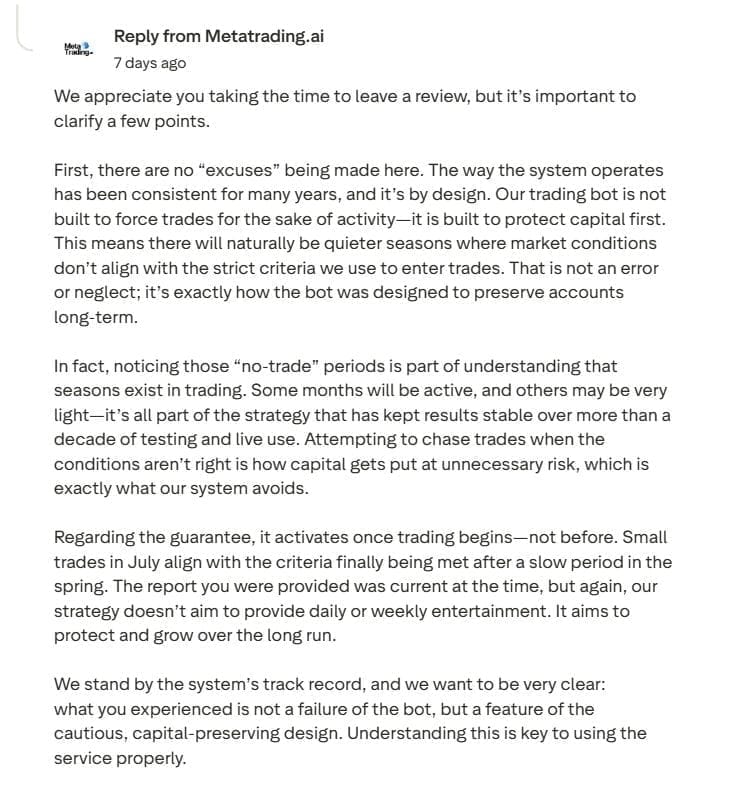

The Critiques: Where Users Point Out Flaws

Being transparent, here are the common complaints I found:

"It's too slow sometimes": During low-volatility, ranging markets, the bot can enter long periods of inactivity. For users craving constant action, this can be frustrating and feel like "missing out."

"I think it's a nice algo but it's a little pricey eh": while the algorithm delivers great value and efficiency, its price was problematic but people still buy it. Solution: Use this link to request a demo first before buying the tool.

Configuration Learning Curve: While setup is simple, optimizing the bot for your specific risk tolerance and goals requires some learning. A few users who jumped in without reading the guides made overly aggressive choices and were unnerved by the resulting volatility.

This balanced feedback is actually a positive sign. A perfect five-star review with no criticisms is a red flag and I think it's suspicious since no business is absolutely perfect.

The complaints here are about expectations and market reality, not about the software being a scam or failing to work as advertised.

It's better to check other reviews on Trustpilot since their Whop Store doesn't have enough.

How It Stacks Up: Metatrading AI vs. The Competition

Having tested many bots, here's how I see it differentiating itself in a crowded field:

| FEATURE | METATRADING.AI | TYPICAL TRADING BOTS |

|---|---|---|

| CORE PHILOSOPHY | Risk Management Diversification: Uses multiple, complementary strategies | Relies on a single strategy that may fail in certain markets. |

| RISK MANAGEMENT | Proactive and multi-layered: features like the Volatility Watcher actively protect capital | Reactive & Basic: Often just a simple stop-loss, prone to failure in flash crashes. |

| TRANSPARENCY | Third Party Verification: Live results are often trackable on platforms like MyFXBook | Backtested fantasies: Only shows optimized historical simulations, no live performance. |

| USER CONTROL | Your Keys, Your Crypto: Trades via secure API Keys with no withdrawal rights | Often Opaque: Some require you to deposit funds into their platform (a major red flag) |

| REALISTIC PROMISE | Sustainable growth: focuses on consistent returns with managed drawdown. | Get-Rich-Quick: Promises absurd returns that are statistically impossible to maintain |

>>Related: Metatrading ai cheaper alternative

Is Metatrading.ai a Scam?

This is the most important question. Based on my hands-on testing and research, my conclusion is a big no, it is not a scam.

Here’s why:

Their company is registered in the US - even though it's not SEC endorsed yet (like most bots).

No Access to Funds: They never hold your money or even see the color of it. This removes the biggest risk factor in the crypto and trading space.

Verifiable Performance: The availability of live, real-money trackers provides a level of transparency that scam operations would never offer. Check out this FXBlue.

Realistic Claims: They aren't promising 5% daily returns. If you saw this somewhere, it's not this AI trading tool. The messaging is focused on risk-managed, sustainable growth, which aligns with the reality of trading.

A scam operation would take the money and run. An active support community and continuous updates indicate a legitimate product.

The risk isn't that Metatrading is a scam; the risk is that all trading, even automated trading, carries inherent financial risk.

You can absolutely lose money if the market moves drastically against the bot's positions. Stay cautious and follow strict guidelines to be and stay profitable on a monthly basis.

>>> I recommend reviewing the live performance stats and user discussions yourself to get the full picture before deciding.

The Final Verdict: Who Should (and Shouldn’t) Use This Bot

After three months of live testing and deep research, here’s my unfiltered conclusion.

Metatrading AI is one of the most legitimate, well-engineered automated trading systems I’ve encountered. It is one of them. It’s not a hyperbolic profit-generating machine;

it is a sophisticated risk-management engine that also generates returns. Don't just see it's value in the gains it can make, but more importantly, in the losses it seems designed to avoid.

Think of it as an assistant to improve your trading instead of a magic overnight cash generating machine. Because it's absolutely NOT.

The focus on strategic asset selection, multiple algorithms for different market regimes, and the brilliant Volatility Watcher feature show a depth of understanding that is absent from 99% of the competition.

This is a tool built by traders, for traders.

Who This Is NOT For:

The Get-Rich-Quick Seekers: If you're looking to turn $100 into $100,000, look elsewhere, I don't know where. This trading bot style is more a marathon strategy than a sprint.

Beginners with No Risk Capital: This is not "investing." This is automated trading, and you must only use capital you are fully prepared to lose. You should also have a basic understanding of how crypto or forex trading works. If you don't, their support provide this guide for free. This is their added value.

The Micromanagers: If you’ll second-guess every trade and shut the bot off at the first sign of a drawdown, you’ll sabotage its strategy. You need to trust the process.

Traders with Very Small Accounts: Due to exchange minimums and the need to properly diversify positions, an account under $10,000 is unlikely to see meaningful, sustainable results.

Who This IS For:

Anyone Willing to build a new passive income stream: You want to supplement your current income on a regular basis. There are nurses getting profit from this bot right now.

Busy Investors: You understand the potential of crypto/forex but lack the time to stare at charts all day. This trading algorithm acts as your full-time trader who takes carefully vetted trades on your behalf.

The Emotionally-Driven Traders: If you know your biggest weakness is FOMO (Fear Of Missing Out) or panic selling, this system removes emotion by executing a cold, logical strategy 24/7. Computers are not emotional, I mean not yet?

The Diversifiers: You have a traditional portfolio (stocks, bonds, ETFs) and want a small, automated allocation to the crypto/forex space without becoming an expert.

The Risk-Aware Realists: You’re not chasing moonshots; you’re interested in a tool that prioritizes capital preservation and aims for consistent, above-average compounding returns.

>>Related: Deeper Analysis of Metatrading.ai - Is it worth it?

My Honest Take: Is Metatrading AI Worth It?

Yes, but with very clear expectations.

Is it worth it as a software? Absolutely. The technology, design, and risk-management framework are top-tier. For the serious trader or investor looking to add automated strategies to their arsenal, it provides immense value.

Is it worth it as a guaranteed profit machine? Nothing is guaranteed. The market is the ultimate decider. It is worth it as a powerful tool that, when used correctly, gives you a systematic, unemotional edge in the market. My test results (+19.54% in 90 days) are realistic and align with their claims.

If you approach it as a long-term strategy for a portion of your risk capital, manage your expectations, and take the time to set it up properly, then metatrading AI is not just worth it—it’s a standout option in a field full of garbage.

>>> If you’re ready to explore Metatrading AI with a clear-eyed perspective, you can access it through their official store.

Frequently Asked Questions (FAQ)

1. How much money do I need to start?

While you can technically start with less, a minimum of $5,000 - $10,000+ is recommended to properly follow the risk management parameters and see meaningful results.

Smaller accounts are more susceptible to volatility and get eat by fees. According to my experience, this tool works best with big portfolios. The bigger you own, the better you perform.

2. Can I really make money while I sleep?

Yes, that’s the core concept. The AI bot operates 24/7 based on its programmed strategies. However, "making money" is never guaranteed.

A more accurate phrase is "it executes its strategy while you sleep." You may need to tweak once a month to see how things turn out.

3. What’s the biggest risk?

Metatrading AI systems are monitored behind the scenes by two species: expert traders and AI quantum analysts. They watch out any event.

The biggest risk is a catastrophic, unprecedented market event (a "black swan") that moves so quickly and drastically that it bypasses the AI bot's risk parameters before positions can be closed.

This is a risk for every trader and every system, automated or not.

4. Do I need to know how to code or be a trading expert?

No. The setup is designed for non-coders. However, my take is a basic understanding of trading concepts like leverage, stop-loss, and volatility will help you configure the bot optimally and understand what it’s doing.

Remember one of the rules of Warren Buffet? Never invest in what you don't know at all!

5. Can I withdraw my money at any time?

Absolutely. Your funds are always on your exchange or in your brokerage account.

The AI bot only has permission to trade, not to withdraw. You can disconnect it or liquidate positions at any second.

6. How much time does it require each week?

After the initial setup (about 15-30 minutes), it requires minimal maintenance. I recommend checking in weekly for 5-10 minutes to review performance and ensure everything is running smoothly.

It is not completely hands-off, but it is significantly less work than manual trading.

BE THE FIRST TO LEARN NEW WAYS TO MAKE MONEY

Learn how to earn money without being 100% involved in the process. Even if you're a beginner.

Learn how to start a private community where people will pay to access your content.

Algorithmic trading uses trading advisors to place trades on the markets to earn profits while you're somewhere else.

12 creative and realistic ideas to turn 10k into 100k for profit. Read more

The New Way to Start Affiliate Marketing. How to make it less time consuming while earning more even as a beginner. Read more

By Julian Croft

Julian Croft (Jesse) is the founder of The Hustle Nation, a blog dedicated to helping introverts build genuine passive income (not the hyped one) through faceless, sustainable methods. After a decade in data analysis, he now uses his research skills to cut through the online hype and deliver actionable, trustworthy advice.

The Hustle Nation is your #1 community to find side hustle ideas, online side jobs and passive income ideas for introverts. Join part-time hustlers on the path to financial freedom with proven strategies, tools, and inspiration to benefit from your free time. Learn newest tricks to earn money on the internet without showing your face on a camera. All our posts are not financial advise. Always do Your Own Research for informed decision.