6 Ideas to Invest 100k for Passive Income in 2025

6 Ideas to Invest 100k for Passive Income in 2025

By The Hustle Nation Team

It's 2025 and wealth-building isn’t just about working harder—it’s about investing smarter to earn significant results in a specific timeframe. Whether you’re planning an early retirement, funding your dream lifestyle, or simply tired of trading time for money, passive income is the golden ticket.

The only thing is: Not all passive income streams have potential.

Some require hands-off ease; others demand upfront hustle. Some flourish in 2025’s tech-driven economy; others just fade out because of the current financial environment.

Below, we break down the 6 best ways to invest $100K for passive income this year—ranked by potential returns, scalability, and real-world success stories. Let’s dive in.

What is passive income

Passive income has nothing to do with get-rich-quick schemes—it’s about building reliable systems that generate cash flow with minimal ongoing effort. Think: rental properties paying rent, dividends from stocks, or royalties from digital products.

Why does passive income matter in 2025?

Passive income seems to be immune to rising costs: inflation.

Technology friendly: AI and automation tools make it easier than ever to generate passive revenue.

Additional income needed: Get more freedom, park your 9-to-5 income, or fund your side hustles using this revenue.

If you want to reach this goal, you should drive the right vehicle. Here are the top ideas to invest your 100k.

Investment Options for Passive Income

1. Real Estate Investments

This option allows you to own one or several properties that pays you rent and appreciates over time. With $100K, you could just:

Buy a REIT (Real Estate Investment Trust): Earn dividends without fixing toilets (e.g., Fundrise yields ~8-12%).

Invest in a Rental Property: As an example, use your $100K as a down payment on a $400K duplex (leveraging financing). Recent statistics show that Airbnb-friendly cities like Nashville are booming in 2025.

Try Crowdfunding via platforms like Arrived that let you buy shares of vacation homes. This allows you to earn passive rental income.

Additionally, Remote work has shifted demand to suburbs in 2025. So, target areas with growing infrastructure (think: Texas, Florida) in priority.

2. Dividend Stocks

With 100k, you can opt for assets like:

High-Yield ETFs: SCHD (3.5% yield) or VYM (2.9%) offer instant diversification.

DRIPs (Dividend Reinvestment Plans): Automatically compound your earnings.

AI-driven dividend stocks (e.g., NVIDIA) are rising and reaching lifetime highs in 2025. Also balance safety and growth.

Aim for a 4-6% average yield. $100K = ~$400-$500/month without lifting a finger.

3. Peer-to-Peer Lending

Why bother, Just Be the Bank (and Pocket the Interest)

Prosper or LendingClub let you loan money to vetted individuals or reliable businesses at 6-12% interest. Lucrative.

In 2025, More small businesses seek loans post-pandemic. This situation allows you to capitalize on higher rates since they need funding in a very short timeframe.

That's when you get in with your 100k

Spread across 200 loans ($500 each) to minimize risk.

Side Idea: Default rates hover at ~5%. Use auto-invest tools to filter high-credit borrowers

4. Index Funds and ETFs

Warren Buffett’s golden rule:

"Never bet against America."

With $100K in low-cost index funds (like VOO or QQQ), you’re buying a slice of the entire market—hands-off and historically unstoppable.

Why 2025?

Because there is an AI Boom Phenomenon: Tech-heavy ETFs (like XLK, NVDA) are surging with AI adoption.

Once you get your system in place, set It and Forget It: Auto-reinvest dividends for compound growth.

Leverage your $100K Power Move: Allocate 60% to S&P 500 ETFs + 40% to global funds (like VXUS) for diversification.

Just to say, a $100K investment in VOO 10 years ago would be worth ~$380K today

5. Hedge Fund Automated Trading

This consists in Hedge Fund Traditional Strategies— but Without the 7-Figure Minimum.

Shortly said, you can trade like those huge funds without owning an extremely high amount.

Robo-advisors like Betterment or algorithmic platforms (e.g., QuantConnect) now let you tap into AI-driven trading—once reserved for the ultra-rich.

How to put $100K To Work in 2025?

Buy Trend-Following Bots: Automatically buy/sell based on market signals (e.g., inflation spikes). One of the best in this category is 3Commas. it's interface is simple to navigate and it support many trading exchanges. Check 3commas reviews on Trustpilot

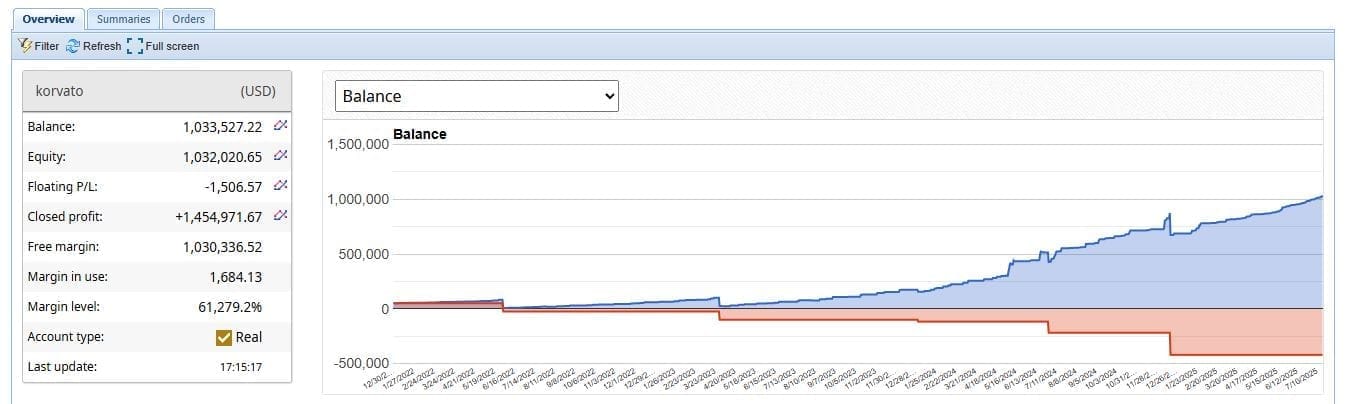

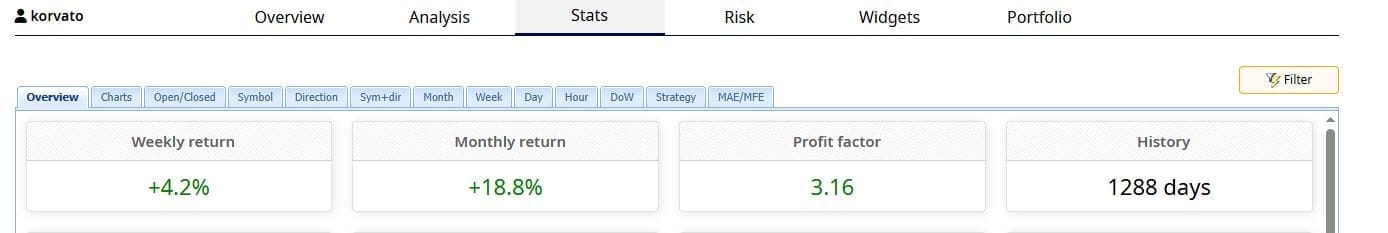

Also consider Korvato, which provide good results (8%+ monthly profit) but has been kept private since a few years. They have a waiting list and are very selective.

Korvato account verified public transactions available on Fxblue - Account age 1288 days

Check Korvato reviews on Trustpilot as well.

Implement Tax-Loss Harvesting: Use Tools like Wealthfront to optimize your returns by reducing tax burdens.

Opt for Forex and Crypto Algorithms to generate passive income: They are Controversial for some but provide nice results when the user is disciplined and strictly respect the trading strategy.

For example services like:

Metatrading ai automates Bitcoin/ETH trades. This 100% automated trading bot powered by AI, Trades on several markets including forex, crypto, futures, etc.

Eminence Pro: a forex trading tool designed for beginners and experienced traders.

Coinrule - A trend following bot compatible with several exchanges like Binance, Bitmex, Kraken etc.

Caution: Crypto related ventures have Higher risk. So, Allocate only 10-20% of your $100K here, follow a strict money management system and listen to your account manager.

6. Buy an Already Profitable Business and earn passive profits.

Forget starting from scratch—own a business that already runs itself and is already generating substantial revenue. With platforms like Flippa, Empire Flippers, or Quiet Light Brokerage, you can buy a cash-flowing online/offline business where the systems (and team) are already in place.

How It Works in 2025:

E-commerce Stores: Buy a Shopify store with automated fulfillment (dropshipping or 3PL). Example: A $100K purchase of a niche skincare brand netting $5K/month and this ecommerce business has been sold for $12M!

Content Websites: Acquire a blog with ad revenue (Adsense or Mediavine) and outsourced writers. Example:

Laundromats/Car Washes: Offline but hands-off—hire a manager and collect profits.

The Automation Secret is simple:

"The goal isn’t to work IN the business but ON it.

The main system to use is to Ensure SOPs (Standard Operating Procedures) exist for every task.

Keep the existing Virtual Assistants (VAs)/freelancers (or hire on PeoplePerHour).

Hire remote customer service agents or use a dedicated AI customer service like Fin AI;

and SaaS (Zapier for workflows).

Creating a Balanced Portfolio

Now, You’ve got six powerful ways to turn $100K into passive income—but here’s the truth: diversification is better (this is just an opinion, it's not a financial advice).

Putting all your money into one asset is like betting on a single horse. Spread it smartly, and you’ll sleep better while your money works harder.

Step 1: Define Your Risk Personality

What is your risk tolerance? Are you…

The Conservative Builder? (Your priority is Stable cash flow, low volatility)

The Balanced Grower? (You need a Mix of safety & growth)

The Aggressive Accelerator? (You're chasing higher returns, comfortable with risk)

Step 2: Sample Some Portfolio Breakdowns

Some portfolio simulation ideas.

Try the Portfolio Simulator

Option A: The Safety-First Portfolio (Conservative)

40% Dividend Stocks (SCHD, VYM) leading to Steady payouts

30% Real Estate (REITs like Fundrise) -- Inflation-resistant income

20% Index Funds (VOO) for Reliable growth

10% Peer-to-Peer Lending (Diversified loans) - Higher yield, managed risk

Projected Monthly Income: ~$1,800-$2,200

Option B: The 50/50 Hybrid (Balanced)

25% Automated Business (Pre-built e-commerce site) ---> Hands-off cash flow

25% Real Estate (Rental property down payment) ---> Appreciation + rent

20% ETFs (Mix of VOO & QQQ) ---> Growth exposure

15% Dividend Stocks ---> Stability

10% Hedge Fund Algorithms (Wealthfront, Betterment or Korvato) ---> AI-powered upside

5% Digital Assets (Stock photos/courses) ---> Side hustle potential

Projected Monthly Income: ~$2,500-$3,500

Option C: The Growth Rocket (Aggressive)

30% Automated Business (High-margin SaaS acquisition) -- Scalable income

25% Tech ETFs (QQQ/XLK) --- Ride the AI wave

20% Crypto Algorithms (Automated trading bots) ---High-risk, high-reward

15% Peer-to-Peer Lending (Small business loans) -- Short-term yield

10% Digital Assets -- Future-proof royalties

Projected Monthly Income: ~$3,000-$5,000 (but expect volatility)

Step 3: Automate & Monitor Your System

Once you have your system all set, hire to automate and monitor or monitor yourself.

Use Dedicated Tools like Personal Capital to track cash flow.

Rebalance Quarterly: Shift money from winners to underperformers.

Tap into Tax Hacks: Hold dividend stocks in tax-advantaged accounts (Roth IRA)

The richest people in the world don’t just invest—they build systems

Setting Up for Success

There are mainly three red flags to consider.

Red Flag #1: "Guaranteed Returns"

Scam Alert: If a pitch promises "18% monthly returns with no risk," run. Every investment involves risk.

No need to remind you the Ponzi schemes like BitConnect that used this language.

Red Flag #2: No Transparency

Legit businesses show you their books (e.g., if they're on sale, they show you listings with verified traffic/profits), not vague numbers.

Sketchy ones say, "Trust us, the numbers are proprietary."

Red Flag #3: Overcomplicated Jargon, don't invest in something you don't understand.

Good: "We use AI to optimize rental pricing."

Bad: "Quantum blockchain AI arbitrage derivatives."

Consider the Reinvestment Flywheel

Start with one stream (e.g., dividend stocks paying $1K/month).

Use that cash flow to buy an automated business (e.g., a $30K content site).

Now you’re earning $3K/month. Reinvest into private lending.

Repeat until your passive income > living expenses.

Example: Sarah turned $100K into $15K/month in 3 years this way.

Most people quit passive income after 6 months either because their system was not well set or they were not consistent in their implementation. So you better

Commit to nurturing your investments for 12 months before expecting life-changing results.

Conclusion

At the end of the day, Your $100K Game Plan might look like this:

1. Pick your mix (Balanced portfolio or celebrity style).

2. Automate relentlessly

3. Reinvest like a machine (implement the Reinvestment wheel tactic).

4. Ignore the noise and stay focus to take better decisions.

"The best time to plant a money tree was 10 years ago. The second-best time? That's today."

This post is not a financial advice. Please do your own research before diving in any venture or consult a financial advisor.

BE THE FIRST TO LEARN NEW WAYS TO MAKE MONEY

The Hustle Nation is your #1 community to find side hustle ideas, online side jobs and passive income ideas for introverts. Join part-time hustlers on the path to financial freedom with proven strategies, tools, and inspiration to benefit from your free time. Learn newest tricks to earn money on the internet without showing your face on a camera. All our posts are not financial advise. Always do Your Own Research for informed decision.